A Comprehensive Overview to How Credit Scores Repair Work Can Transform Your Credit Report

Comprehending the intricacies of credit rating fixing is important for anyone looking for to boost their monetary standing. By dealing with problems such as settlement background and credit report utilization, individuals can take proactive steps towards enhancing their credit history scores.

Comprehending Credit History

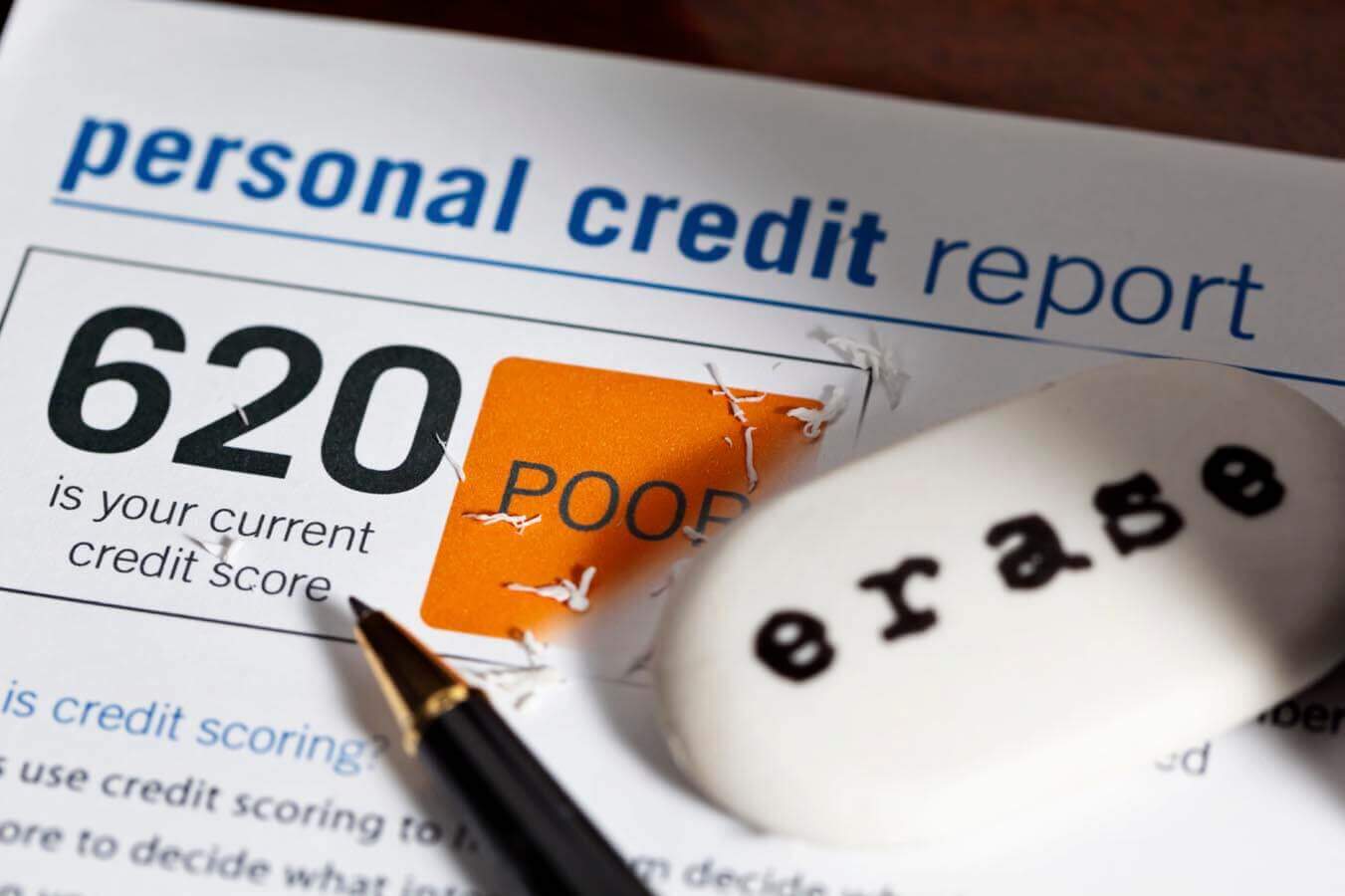

Comprehending credit report is necessary for anybody looking for to boost their monetary wellness and access better borrowing choices. A credit rating is a mathematical representation of an individual's credit reliability, generally ranging from 300 to 850. This rating is generated based upon the details contained in a person's credit history record, that includes their credit rating, impressive financial obligations, settlement background, and kinds of charge account.

Lenders use credit history to assess the risk related to providing cash or extending credit rating. Greater scores indicate reduced threat, typically resulting in extra desirable funding terms, such as lower rate of interest and higher credit line. Alternatively, lower credit rating can result in higher rate of interest or rejection of credit scores completely.

A number of aspects influence credit report, including repayment background, which makes up about 35% of the rating, followed by credit rating use (30%), length of credit report (15%), kinds of credit history being used (10%), and brand-new credit report queries (10%) Recognizing these aspects can encourage individuals to take actionable steps to boost their ratings, inevitably improving their financial possibilities and stability. Credit Repair.

Typical Debt Issues

Lots of individuals encounter typical credit problems that can prevent their monetary development and influence their credit history. One common concern is late payments, which can substantially harm debt scores. Also a single late settlement can stay on a debt report for a number of years, impacting future borrowing potential.

Identification theft is another significant worry, possibly leading to deceptive accounts showing up on one's debt report. Dealing with these usual credit history concerns is important to boosting economic health and establishing a strong debt profile.

The Debt Fixing Process

Although credit scores repair work can appear complicated, it is a methodical process that people can carry out to boost their credit rating and remedy inaccuracies on their credit score records. The primary step includes obtaining a copy of your credit report from the 3 major credit report bureaus: Experian, TransUnion, and Equifax. Testimonial these reports meticulously for mistakes or disparities, such as inaccurate account details or out-of-date details.

Once mistakes are recognized, the following step is to contest these mistakes. This can be done by contacting the debt bureaus straight, supplying paperwork that sustains your claim. The bureaus are needed to examine disagreements within 30 days.

Preserving a regular payment background and managing credit rating utilization is likewise crucial throughout this process. Monitoring your credit report on a regular basis guarantees continuous precision and helps track renovations over time, reinforcing the efficiency of your credit report repair service initiatives. Credit Repair.

Benefits of Debt Repair Work

The advantages of credit rating fixing expand much beyond just boosting one's credit rating; they can dramatically affect monetary security and possibilities. By attending to mistakes and unfavorable items on a credit report, people can improve their creditworthiness, making them more appealing to loan providers and banks. This renovation usually causes far better passion prices on car loans, lower costs for insurance coverage, and increased chances of authorization for charge card and mortgages.

Furthermore, credit history repair can promote accessibility to important services that call for a credit scores check, such as leasing a home or acquiring an energy solution. With a healthier credit report profile, people might experience enhanced confidence in their monetary decisions, enabling them to make larger acquisitions or financial investments that were formerly out of reach.

Along with substantial monetary benefits, credit repair work cultivates a sense of empowerment. People take control of their monetary future by proactively handling their find out here credit scores, resulting in more informed choices and higher financial literacy. In general, the benefits of credit repair add to a more secure economic landscape, eventually advertising lasting financial growth and personal success.

Choosing a Credit Scores Repair Work Solution

Picking a debt fixing solution calls for cautious factor to consider to make sure that individuals receive the support they need to improve their monetary standing. Begin by looking into potential companies, concentrating on those with favorable customer evaluations and a tried and tested performance history of success. Openness is crucial; a reputable solution should clearly describe their explanation their timelines, processes, and costs ahead of time.

Next, verify that the credit history repair work solution follow the Credit rating Repair Organizations Act (CROA) This federal legislation shields consumers from deceptive methods and collections standards for credit history repair work solutions. Stay clear of business that make impractical guarantees, such as assuring a specific rating increase or asserting they can get rid of all unfavorable things from your report.

Additionally, think about the level of consumer assistance used. An excellent credit rating fixing solution should provide personalized support, permitting you to ask questions and obtain prompt updates on your development. Look for services that use a detailed evaluation of your credit scores record and establish a tailored approach customized to your specific circumstance.

Inevitably, selecting the appropriate debt repair work solution can lead to significant enhancements in your credit history, equipping you to take control of your financial future.

Verdict

Finally, effective credit scores repair work strategies can dramatically boost credit history by attending to usual concerns such as late payments and inaccuracies. A thorough understanding of credit report factors, combined with the interaction of reputable credit repair service solutions, promotes the settlement of adverse things and recurring progression tracking. Inevitably, the effective improvement of credit report not only results in far better financing terms but likewise cultivates greater economic chances and security, highlighting the importance of aggressive credit administration.

By attending to problems such as repayment background and credit report use, individuals can take proactive steps toward boosting their debt scores.Lenders make use of debt ratings to assess the risk linked with lending cash or expanding debt.Another constant trouble is high credit application, specified as the proportion of current credit rating card balances to complete readily available credit score.Although credit report repair can seem overwhelming, it is a methodical process that people can carry out this contact form to enhance their credit history scores and rectify errors on their credit rating records.Following, validate that the credit report repair work solution complies with the Credit history Repair Work Organizations Act (CROA)